As I sat down to write my first blog of 2021, it’s natural to look back at 2020 and say, “Wow! I didn’t see that coming.” I think many of us thought that if we got through the rest of 2020, the world would somehow return to some sense of normalcy in 2021. Well, here we are and its obvious the first few weeks of 2021 have been just as wild and unpredictable as 2020. Is it possible that market uncertainty is not a temporary state but the new normal?

A Look Back on 2020

For years before COVID, CFOs and analyst reports stated there was room for improvement in FP&A, including the need to:

- Streamline reporting

- Improve budgeting

- Increase forecasting frequency and accuracy

- Model scenarios to mitigate risk

- Consolidate and close the books faster and with greater accuracy

One of the primary roadblocks to these improvements is that finance teams are already too busy with standard FP&A processes, leaving little room to tackle new projects or focus on more strategic work.

Last March, when pandemic-related closures and global lockdowns began, CFOs and finance leaders began to feel the impact on markets and businesses, forcing them to abandon the budgets and plans they’d recently implemented. They had to turn their attention to triaging cash flow, resetting revenue expectations, and controlling costs. Finance leaders were then tasked with assessing all the available data and planning a way forward for their business. This involved revisiting existing processes while also increasing forecast frequency and scenario modeling, if not already done by the Office of Finance.

See how to transform your approach to scenario planning with CPM software.

What is Continuous Planning?

The uncertainty of 2020 has ushered in a new era. An era where the CFO and senior finance leaders are tasked with need to be in mode of “continuous planning,” now essential to the survival of many organizations. As such, the CFO has been elevated to a more strategic role within most companies whether they like it or not. So, what exactly is continuous planning?

Continuous planning is an approach to planning where static annual or bi-annual plans are replaced with a continually updated plan, which is revised every time an internal or external event (such as a shift in priorities, an unexpected delay in a given program, or a change in the business environment) occurs.

To further complicate matters, many companies employees were suddenly forced to work remotely, which put added strain on finance teams in the form of hampered collaboration, and difficulty accessing in-house financial systems such as their ERP. This introduced further complications and delays into FP&A processes that already needed optimizing, as we discussed earlier.

In a blog I wrote last year called, “The Why and How of CPM-Powered Scenario Planning,” I spoke about how cloud-based Corporate Performance Management (CPM) software can help organizations navigate an uncertain future by enabling remote finance teams to streamline FP&A processes.

Continuous planning is easy with CPM software – learn more on our website.

Improving Your Financial Close

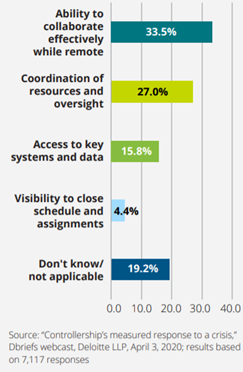

Many organizations’ year-end close for 2020 will be more difficult to put together and look quite different than previous years. According to Deloitte, the biggest challenges in closing the books remotely are:

Many organizations’ year-end close for 2020 will be more difficult to put together and look quite different than previous years. According to Deloitte, the biggest challenges in closing the books remotely are:

- Ability to collaborate effectively

- Coordination of resources and oversight

- Access to key systems and data

- Visibility

So, what can a company do to improve their financial close?

Four Ways Prophix Can Improve Consolidation and Close

You might be surprised to hear that the same software that can be used to streamline budgeting, planning, and reporting into a continuous planning approach can also be used to improve consolidation and close processes. Prophix is one of a handful of CPM vendors that can do this. Prophix does this by:

1. Supporting Finance and Accounting in a Remote Working World

COVID-19 has ushered in the age of the virtual accounting function. This will be a priority in the coming years, as 74% of CFOs say they plan to grow remote work permanently. Therefore, the applications finance teams use every day need to be responsive to the way they work.

Prophix is a cloud-based CPM solution, so it is easily to access remotely with an internet connection. It can also be integrated with all your other applications (ERP, CRM, HR, etc.) so, all your financial data is readily available in the system. It truly becomes your single view of your financial truth. By enabling users to access your data with an internet connection, Prophix enables you to collaborate remotely and close your books from anywhere.

2. Increase the Speed, Accuracy, and Auditability of Consolidation

With the growing need to reduce the time it takes to complete FP&A tasks, freeing up additional time for more strategic work is a challenge that CPM software has been successfully addressing for years. Manual spreadsheet-based processes simply do not scale anymore. The same can be said about consolidation. If manual consolidation is still taking too much of your time, Prophix can help!

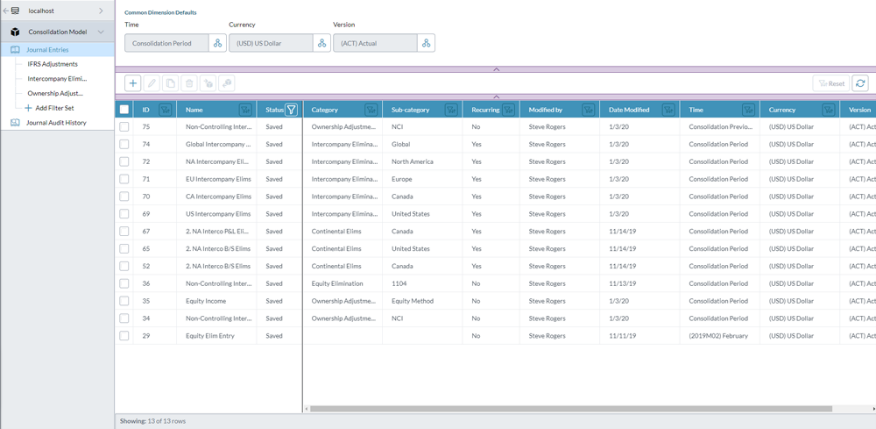

Using a CPM tool will simplify collaboration by integrating with all your business systems, centralizing your data, and enabling information tracking. Streamline processes like intercompany eliminations, adjustments, currency translations, and more in a single unified system, while meeting regional reporting standards like IFRS or US GAAP with complete auditability. Administrators can monitor the consolidation process and report on its status at any time, helping to drive collaboration, simplify consolidation, and speed up close.

3. Automate the Assembly and Distribution of Reports

During a quarterly or annual close, it can take anywhere from hours to days to collect the required data, assemble it into a professional document, and distribute the reports to internal and external stakeholders. To streamline this process, Prophix’s Report Binder is a feature that can be used to automate the assembly of period reports, saving valuable time while ensuring a consistent format such as an annual report or a board book.

During a quarterly or annual close, it can take anywhere from hours to days to collect the required data, assemble it into a professional document, and distribute the reports to internal and external stakeholders. To streamline this process, Prophix’s Report Binder is a feature that can be used to automate the assembly of period reports, saving valuable time while ensuring a consistent format such as an annual report or a board book.

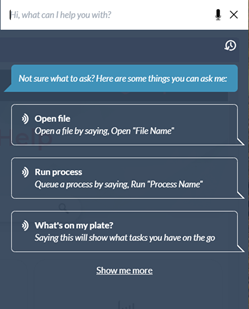

Report distribution can also take time and is a traditionally manual process – not anymore! Using Prophix’s Task Assistant, found in the AI-powered Virtual Financial Analyst, you can automatically distribute reports to individuals or groups expediting report delivery. Simply ask Task Assistant to schedule a process or to distribute the reports to individuals or groups, and then consider it done. Task Assistant look after the recurring tasks saving even more time and allowing you to stay focused on the business.

4. Leverage AI Analysis Resolve Risky Transaction to Close Even Faster

One of the more complex aspects of closing the books is risk assurance. Depending on the number of transactions an organization performs in a given period, making sure the financial figures are correct, free from errors, omissions, and any suspect activities can be a frustrating task that ultimately extends close windows.

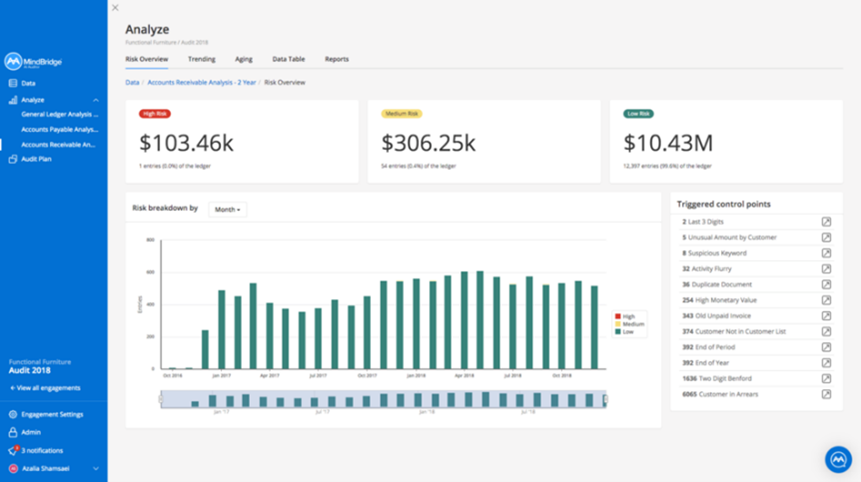

What if you had access to technology that would review 100% of your data and report on all the risky transactions in near real-time? Prophix’s Anomaly Detection has you covered! By leveraging Machine Learning, it automatically detects and surfaces unusual transactions, and then intuitively organizes them by risk rating, expediting the investigation and subsequent resolution of unusual entries transactions that would typically have gone unnoticed before. To learn more, I dive into this in much greater detail in a recent blog titled, “Make Financial Consolidations & Close Intelligent with Artificial Intelligence (AI) and Automation.” The takeaway here is that by resolving all your unusual transactions ahead of time, you will reduce your close window, while also making it more accurate and less risky than ever before.

CPM Benefits Your Consolidation and Close

In short, the message I’m trying to convey is that CPM software is a compelling option to help expedite your consolidation and close process. The same attributes that make CPM software a great budgeting, reporting, and planning platform also make it a terrific close solution. Having your budgeting, planning and close performed in the same solution provides you a holistic view of the financial state of your business. Prophix not only reduces planning windows and increases accuracy with data integration and automation but also applies the same methodology to streamlining financial close.

And with remote work as the new normal, Prophix cloud is accessible to anyone on any device with an internet connection. The benefits of centralized data, automation, and collaboration can be experienced by all finance and accounting team members, regardless of where they’re working.

With today’s blog in mind, imagine all the time you could save on your consolidation and close processes with Prophix. Your team could focus on more strategic work like forecasts and scenario plans and adapt to a mode of continuous planning. Not to mention, you can cut down on the long days, late nights, and weekend catch-up sessions!