Why growing companies need to invest in Finance Automation

Year-end Close was a Difficult Process before Covid!

Even in a “normal” year, year-end always arrives too soon, and the improvement projects you planned last year haven’t been done.

Even in a “normal” year, year-end always arrives too soon, and the improvement projects you planned last year haven’t been done.

All throughout the year you are reacting to the changing marketplace and what your business needs. In a fast-paced changing world with not enough resources, your focus goes to the urgent needs first. Improving your year-end processes ends up on the “nice to do” list.

Most of the time, the business keeps you focused on P&L profits, keeping up with transactions without enough resources, managing cashflow, and putting out the fires that happen because Finance wasn’t looped in ahead of time.

The goal of closing the books ACCURATELY conflicts with the other 2 goals: TIMELY and EFFICIENT.

During the year you end up cutting corners because you need to hit the month-end deadline and you don’t have time to create sustainable processes for new transactions or reports. You whip up a quick excel sheet to get through the month, thinking you’ll build the process properly next month. But of course, next month you’re on to the next fire to put out!

And now year-end arrives, and you’re looking at new accounts for the first time all year. And now the errors that have happened because of the “quick & dirty” workarounds that different teams have created to achieve their own deadlines, have now created a mess that needs to be untangled. The auditors are arriving in a few weeks, and it’s not timely, efficient, or accurate.

All that was BEFORE Covid! And then 2020 happened, and now in addition to the manual sheets and workaround processes you were dealing with to get year end done, your business is likely in some form of crisis and everyone is working from home. You’re managing your team remotely, and you are either struggling with too little revenue, unpredictable revenue, or in some cases your supply chain has blown up because there is too much demand and little inventory.

All these scenarios just make an already difficult process near impossible!

Common Symptoms of a Year-End Process that Needs Help:

The first one – and it’s expensive – is the auditors are in for weeks before, during and after year-end, doing transaction testing, reconciliations, and variance questions that never seem to end.

The first one – and it’s expensive – is the auditors are in for weeks before, during and after year-end, doing transaction testing, reconciliations, and variance questions that never seem to end.

Your team is stressed trying to produce basic numbers which means a lot of late nights to hit the deadlines. Nothing is simple. Any type of update to the numbers requires a LOT of manual work because systems aren’t automated. Different teams use different systems, and everybody has different numbers. Nothing ties!

Excel is the band-aid to your process and system gaps because your existing process and systems can’t deliver what your business needs. This is Excel hell!

The highest cost of poor process and systems – we make it nearly impossible for good people to do their jobs.

So Why is Closing the Books so Hard?

Because we don’t do it properly each month.

Because we don’t do it properly each month.

Why not?

Because it takes too long.

Who can close the P&L, and do full Balance Sheet reconciliations, full variance analysis, and get all the reports done and out in 6 days? Which is what it should be if you’ve got good process, systems, and adequate staff.

In most of the Finance teams I’ve run we would spend a full 10 days on month end (that’s half the month!) and even that was just to get the critical reports done. And I admit there were times we just ran out of month and had to move on to the next one!

You just don’t get to the balance sheet accounts – especially not the complicated ones. These will be different in each business, but wherever there is complexity in your business, then there are estimates and accruals that go with that. But it’s easier to do those quarterly, and often just at year end.

And when you don’t look at accounts closely all year, thinking it will be the same as the previous year, you get surprised. And now you’ve lost the benefit of time and you have a full year’s worth of error-filled transactions to sort through, to try to balance in the few weeks before the auditors walk in the door.

How does Closing the Books become so complicated?

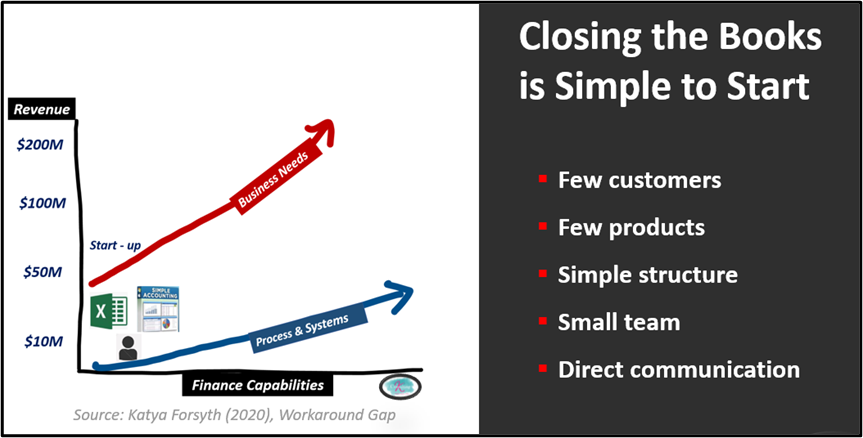

Closing the Books is Simple to Start

Closing the books doesn’t start out that hard. In fact, at the beginning it’s straightforward. Your company starts out with a bookkeeper, a basic accounting package and you record transactions as they happen.

Closing the books doesn’t start out that hard. In fact, at the beginning it’s straightforward. Your company starts out with a bookkeeper, a basic accounting package and you record transactions as they happen.

The team is small, and it’s not that hard to keep track of what’s going on. Your customers are similar, you have a few products, you probably only sell in one country. Your weekly team meeting tells you what you need to know, and you can keep up.

The reporting requirements aren’t that complex, and you produce a simple P&L each month. Year end is a bit more work, but you’re done in a few weeks.

Changing Business Needs adds Complexity

Now if all goes well your business starts to grow, often in unpredictable ways. You start adding new products, new customers, and new geographies. Each of these new types of transactions must be added into the reporting process quickly – so it’s usually handled the same way as the ones that came before, or a new process is quickly tacked on to handle any variation.

Now if all goes well your business starts to grow, often in unpredictable ways. You start adding new products, new customers, and new geographies. Each of these new types of transactions must be added into the reporting process quickly – so it’s usually handled the same way as the ones that came before, or a new process is quickly tacked on to handle any variation.

Then you complete your first acquisition

You implement a bigger accounting package – often your first ERP is around this time. You might inherit the package that comes with the acquisition or put in a new one. Now you need to complete a quarterly reporting pack – either for investors or banks. You might have a system to do this for you – but more likely you build out what you need in Excel after you dump the data from the system.

You complete a 2nd acquisition, or a financing event and the reporting requirements keep growing

You keep adding more bodies to the team trying to catch up. You’re still working on fully integrating the businesses, creating more efficient processes and now have to build bigger reporting packs for more people. You need budgets, rolling forecasts and multi-currency cashflow models.

You just need a few months without more changes to get your systems and processes in shape, but you never get time to catch up. The business is so used to you performing daily miracles they assume you can continue indefinitely.

Instead of a few months to catch up, Acquisition #3 is on the horizon, but you’re still working on integrating #2! Your team is at a breaking point, because too many processes and reports are still manual, which leads to errors and rework, frustration, and stress.

THIS IS THE WORKAROUND GAP

Your systems are full of manual workarounds to connect systems, fix data and fill in the gaps. Your systems and processes don’t have the capabilities you need, and you band-aid the problem with extra people and excel.

At some point the system will collapse – either because your people leave, or a new event will overwhelm the capabilities.

Stay tuned for Part 2 in our Closing the Books series…..

Stay tuned for Part 2 in our Closing the Books series…..

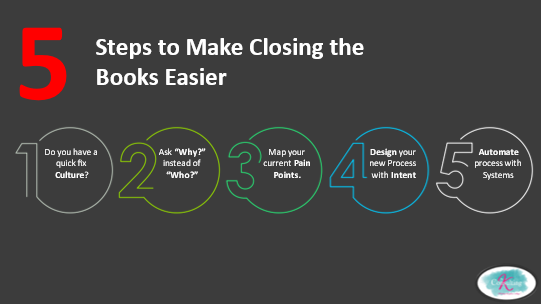

5 Steps to Make Closing the Books Easier

Want to Learn more?

Watch our webinar and learn step-by-step how to implement this approach in your own business.