Embracing new Technologies to Succeed in times of Change

Katya Forsyth

Aug 19, 2021, 2:25:00 AM

Katya Forsyth

Aug 19, 2021, 2:25:00 AM

Why growing companies need to invest in Finance Automation

The Current State of Finance

There is a transformation happening in the office of Finance. Finance leaders are becoming the partners to the business we have always wanted to be.

We’re doing real-time analysis, driving current business decisions. All this data we now have access to is changing the game. We have real-time data, integrated into insightful reports, drill down dashboards, with all the information we need at our fingertips. Our teams just push a few buttons and make it all happen.

Right?

Unfortunately, the reality is less than

5% of Finance teams are really experiencing anything close to that. Closing the books and forecasting still take too long, so we end up using spreadsheets and

“guesstimating” when we need to make decisions quickly. We use the best data we have, not the real, accurate, up-to-date data we really need. Too often we are still doing

“quick and dirty” analysis, or

“back of the envelope” calculations.

We have enough horsepower in our phones to send spaceships to Mars, so why are we still using one-off spreadsheets to make mission critical decisions for our businesses?

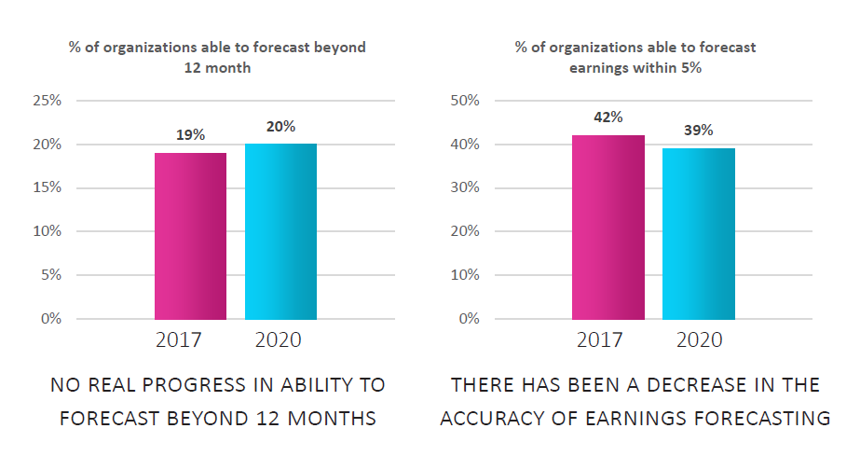

Little Progress has been made in Planning capability

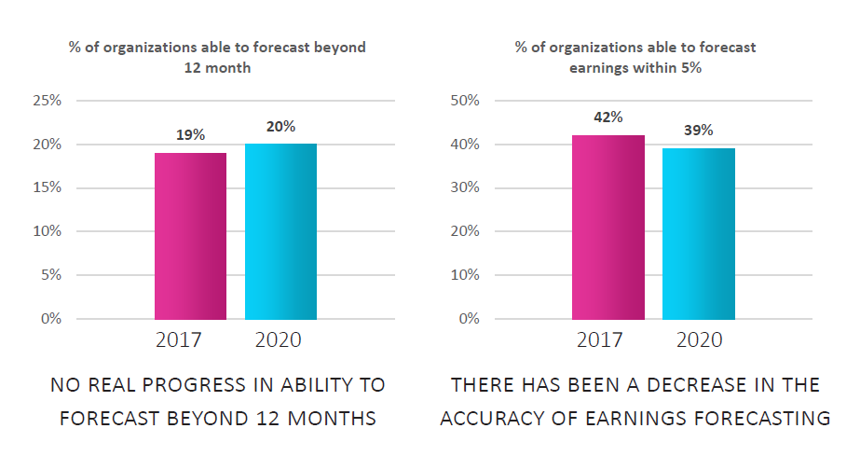

As we begin to emerge from the immense challenges of the last 15 months, it’s a good time to reflect on what worked well, and what can be improved, particularly in Finance. A survey of finance professionals from over 500 companies around the globe provided their insights on how they performed last year, what tools they were using and their ability to forecast. Not surprisingly, the research confirmed that the planning, budgeting, and forecasting (PB&F) process was the most disrupted of all core finance processes. Companies found it difficult to reforecast quickly and accurately in a period of stress and change.

So, what did the survey results show? Overall, companies are forecasting faster than in the past, but accuracy has deteriorated. Two-thirds of organizations can reforecast within a week, but

only 39% can forecast earnings to within +/- 5% accuracy.

A whopping 80% can’t look out more than a year. Considering the supply chain shocks we are still incurring from last year, that alone warrants investing in better forecasting!

How can we become more agile, and better prepared in the face of any type of crisis, as well as the more “normal” business changes we regularly face, like acquisitions, disruptive competitors and ever-changing business models?

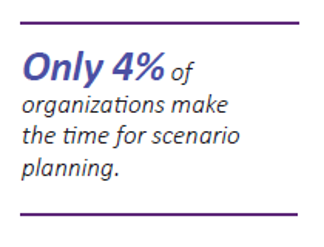

Scenario Planning

The Covid-19 pandemic prompted a surge in interest in scenario planning as executives looked for a better way to plan for an uncertain future. Companies with the ability to scenario plan outperformed all others in the ability to forecast with speed and accuracy. Why? Because they are

less reliant on spreadsheets, as they have already invested in specialist tools. They aren’t overloaded with too much data and too little information.

Without automation, it is almost impossible to simultaneously model multiple scenarios, assumptions, and variables.

So why have only

4% of organizations made time for scenario planning? Too many are stuck in spreadsheet hell. Rolling forecasts is another tool that makes companies more agile in their planning, yet uptake has been slow at just

19%. Again, it’s another technique that is difficult to build, maintain and manage in spreadsheets.

Data needs to be fundamentally improved

Most Finance executives agree that data needs to be improved. The quality of data used determines the quality of forecasting.

Garbage in = garbage out. To improve data quality, we need to cast a wider net and identify operational data outside of the GL, customer relationship data and other non-financial data to improve our forecasts.

The explosion of social media data is an example of new types of data that can be used to spot trends and be used in forecasting. As the data pool increases, using the right tools to analyze these diverse types of data can be a competitive advantage.

However external data still seems to take a backseat to internal data, likely because we still haven’t optimized our internal processes and tools to capture that data efficiently.

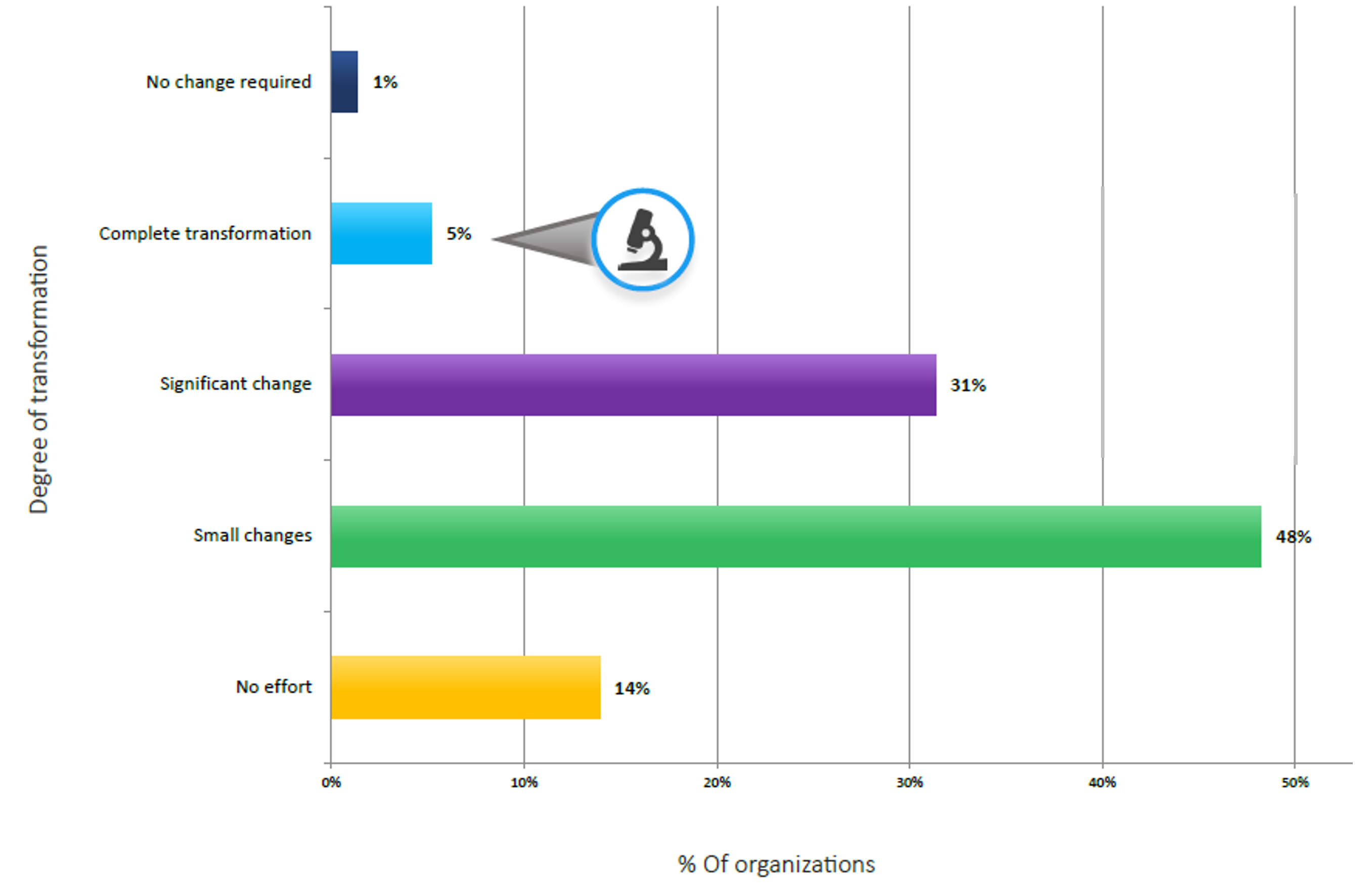

Transformation Improves Agility

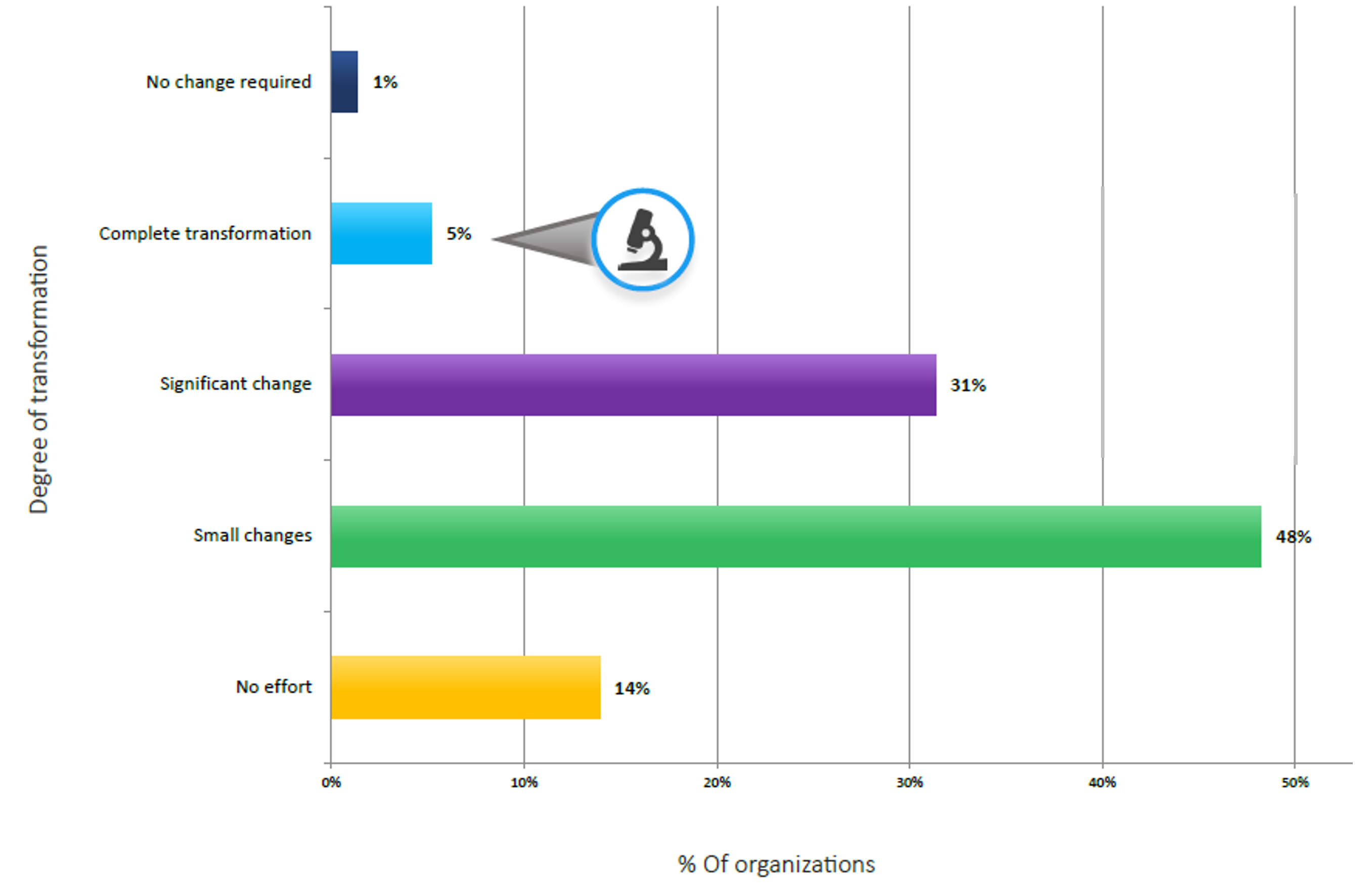

Preparing for and managing change is a fundamental part of business success. Yet, most organizations have not made any major changes to their PBF processes in the last 3 years. And it’s not because change isn’t needed! To understand how transformation impacts the agility of planning, budgeting, and forecasting, the survey compared the 5% of companies that have completely transformed their functions to the 14% that put no effort into it in the last 3 years.

What can we learn from the 5% of transformation leaders who have completely transformed their PB&F process? How are they able to manage their data as a corporate asset rather than being overwhelmed by disconnected spreadsheets with poor data governance?

They have these common elements:

- One source of the truth for their data, that comes from a centralized business model, usually in the cloud

- They use more advanced tools like AI and visualization

- They place a premium on eliminating spreadsheets for data collecting and reporting

This then enables them to implement rolling forecasts, zero-based budgeting, and scenario planning. Whether you choose to use all of these or just some, they

ALL contribute to increasing the agility of the PBF process.

How to make your Planning more Agile

So how can you start to implement these changes? There is no easy button, and few organizations seem to have the time or energy for the massive transformation efforts that build these tools from the ground up. Yet there is no question we need to be able to forecast our revenue accurately, have the right level of workforce and suppliers, and enough cashflow to pay for it all.

Logically we know we should do it, and we know it will have a positive ROI.

So, what’s the problem? In my experience, in very manual environments, it takes so much work just to complete the day-to-day deliverables, it can seem overwhelming to even think about trying to build the proverbial new plane, while you’re working so hard to fly the old one.

Have you reached that point?

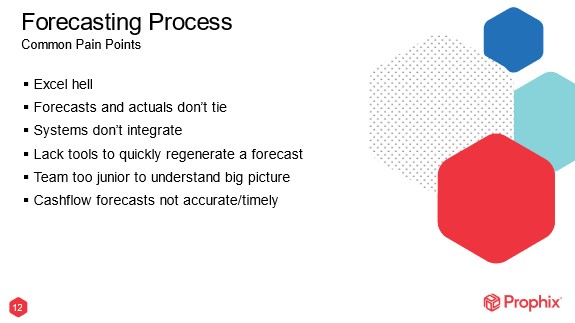

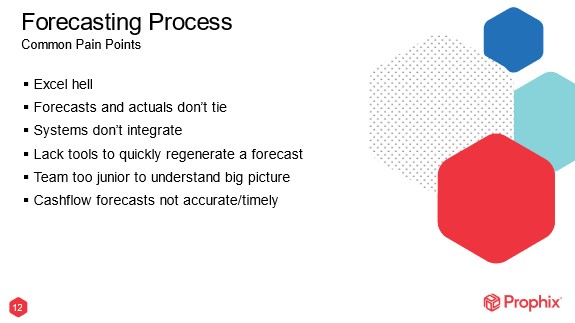

Common Pain Points

Below are some of the common pain points in teams with overly manual process and systems. If this scenario sounds familiar, it is likely time to consider taking steps to upgrade your tools.

When you try to update your forecasts with actual results, the data from the GL doesn’t line up with the forecast assumptions. The forecasts are built with assumptions that aren’t captured in the GL. So the month end variance analysis doesn’t help you explain the change in your forecasts.

If you can’t explain the changes in your actuals, how can you update your forecasts? If your data systems don’t integrate, then every time you get actuals you have to redo your analysis. It takes too long, so you only do it once a quarter, or more likely when there is a dramatic change that forces it. By then it’s too late. You’ve missed the early signals that would have allowed you to react, and now you’re back in a crisis reacting.

When your data and systems aren’t integrated, you rely on the institutional memory of employees, who use their “past experience” as a guide as to what the issue is. But looking in the rear-view mirror for answers isn’t good enough anymore. And it makes you even more vulnerable when you lose those employees, because now your institutional knowledge just walked out the door.

The last year showed us how critical it is to be able to accurately predict cashflow needs

AHEAD of time, to enable the right level of adjustments – whether it be cost cutting, bridge financing or finding alternate sources of revenue. If you’re just guessing or hoping that you will get through a crisis, the battle is already likely lost. You just don’t know it yet.

In reviewing forecasting challenges, we also need to focus on the month-end close process – the source of much of our data.

Month-end is the KEY source of your actual financial data that flows into forecasts.

If you don’t capture data at the level you want it for forecasting, you will never have alignment between your data coming from different systems. When the planning team can’t get what they need from the GL, they go grab reports from SalesForce, from sales cubes, and from other operational reports. And when the data doesn’t line up, it’s one more variable to reconcile.

And if there is not enough discipline in the upstream business processes to capture data in the right periods, then you have timing differences and catch=ups/reversals that will create so much noise around your data that you will be lucky to catch the signals that warn you of changes in the first place.

A disciplined month-end process that is tightly integrated with the upstream business processes takes a lot of effort to create and maintain. But if done right, can create the payoff of clean, accurate data to feed into your forecasting process.

With the right tools and automation, the Finance team can spend their time doing analysis on the changes and highlighting the signals of change the business needs to act on, instead of burning out working late nights just trying to get the numbers to tie.

Create a Centralized Business Model

How can we start to do this better without ripping out all our systems and starting from scratch?

First – you need to start looking at your business and the key data in a centralized way. Each team can’t have their own set of KPI’s in their own spreadsheets. You need to

choose the critical KPI’s that EVERYONE will use, capture them, track the trends, and work together across the company as one. From order to cash, procure to pay and your people processes.

That’s what

ONE source of the truth means. Keeping the data clean.

If you keep dumping the data into spreadsheets to get what you need, then you don’t have the systems you need, or you haven’t configured them properly to fit your needs.

Do an inventory of ALL the mission critical spreadsheets in use in your company and then determine WHY the spreadsheet is needed.

If the data is critical to the mission of the company, then it’s worth investing in the proper tools to do it right. If it’s not, then stop measuring it.

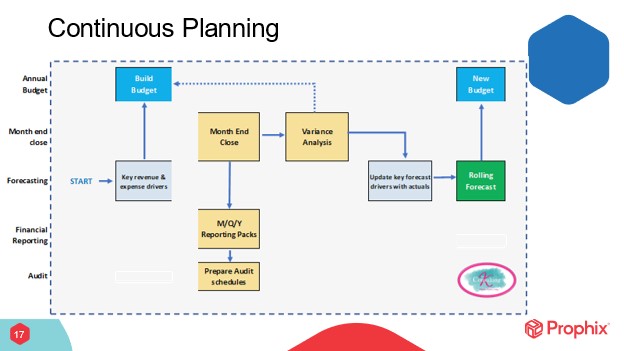

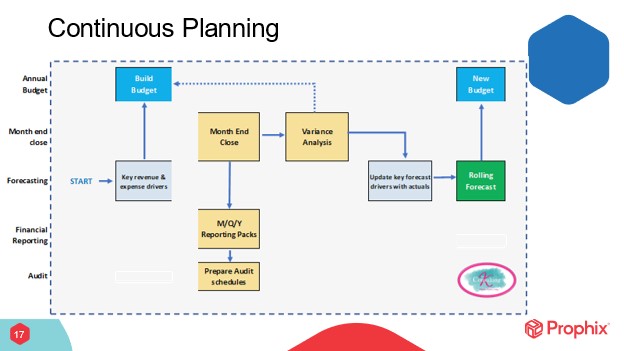

The flowchart below is an example of how you can integrate ALL your processes in Finance.

In my experience the Planning teams and Reporting teams tend to focus on different priorities and projects at any given time. The reporting team is usually rushed on month end or year end looking backwards, and the planning team is working with the business looking forwards.

But if you can take the time to agree on the key revenue and expense drivers for the business as a whole, and educate

ALL the teams on the importance of capturing the critical KPI’s at every step, then you can hand off data from one team to the other much more seamlessly.

You don’t need sophisticated tools to do this part – it’s the discipline to take the time to design your process as an integrated whole, instead of individual cycles. And once you have that, you have the foundation you need to successfully implement the right planning tools.

Key Takeaways

1 –

Centralize your business model by integrating your processes and create one source of the truth. The hard work is in aligning your processes between functions to eliminate the inefficiency and rework that comes from each team designing for themselves. The payoff makes it worth it!

2 –

It’s time to get rid of the spreadsheets. You’ll never get out of excel hell until you make it a priority.

3 – To break the spreadsheet habit

, automate with the right tools.

It is so critical to invest in these tools before the next crisis hits us. There will never be a time when it’s easy, just a time when with determination, resources and making it a priority, you can get it done.

Want to Learn more?

Learn step-by-step how to implement this approach in your own business. To see the results of the survey discussed in the article

click here

Katya Forsyth

Katya is a seasoned CFO who has transformed the office of Finance across multiple companies and industries. In Katya’s latest role as CFO Advisor, she provides guidance to fast growing companies in Finance, Strategy, and Technology. Katya shares her experience in leadership, diversity, and fitness daily on LinkedIn with her #KickglassKat content.

There is a transformation happening in the office of Finance. Finance leaders are becoming the partners to the business we have always wanted to be.

We’re doing real-time analysis, driving current business decisions. All this data we now have access to is changing the game. We have real-time data, integrated into insightful reports, drill down dashboards, with all the information we need at our fingertips. Our teams just push a few buttons and make it all happen.

Right?

Unfortunately, the reality is less than 5% of Finance teams are really experiencing anything close to that. Closing the books and forecasting still take too long, so we end up using spreadsheets and “guesstimating” when we need to make decisions quickly. We use the best data we have, not the real, accurate, up-to-date data we really need. Too often we are still doing “quick and dirty” analysis, or “back of the envelope” calculations.

There is a transformation happening in the office of Finance. Finance leaders are becoming the partners to the business we have always wanted to be.

We’re doing real-time analysis, driving current business decisions. All this data we now have access to is changing the game. We have real-time data, integrated into insightful reports, drill down dashboards, with all the information we need at our fingertips. Our teams just push a few buttons and make it all happen.

Right?

Unfortunately, the reality is less than 5% of Finance teams are really experiencing anything close to that. Closing the books and forecasting still take too long, so we end up using spreadsheets and “guesstimating” when we need to make decisions quickly. We use the best data we have, not the real, accurate, up-to-date data we really need. Too often we are still doing “quick and dirty” analysis, or “back of the envelope” calculations.

So, what did the survey results show? Overall, companies are forecasting faster than in the past, but accuracy has deteriorated. Two-thirds of organizations can reforecast within a week, but only 39% can forecast earnings to within +/- 5% accuracy. A whopping 80% can’t look out more than a year. Considering the supply chain shocks we are still incurring from last year, that alone warrants investing in better forecasting!

So, what did the survey results show? Overall, companies are forecasting faster than in the past, but accuracy has deteriorated. Two-thirds of organizations can reforecast within a week, but only 39% can forecast earnings to within +/- 5% accuracy. A whopping 80% can’t look out more than a year. Considering the supply chain shocks we are still incurring from last year, that alone warrants investing in better forecasting!

The Covid-19 pandemic prompted a surge in interest in scenario planning as executives looked for a better way to plan for an uncertain future. Companies with the ability to scenario plan outperformed all others in the ability to forecast with speed and accuracy. Why? Because they are less reliant on spreadsheets, as they have already invested in specialist tools. They aren’t overloaded with too much data and too little information.

The Covid-19 pandemic prompted a surge in interest in scenario planning as executives looked for a better way to plan for an uncertain future. Companies with the ability to scenario plan outperformed all others in the ability to forecast with speed and accuracy. Why? Because they are less reliant on spreadsheets, as they have already invested in specialist tools. They aren’t overloaded with too much data and too little information.

What can we learn from the 5% of transformation leaders who have completely transformed their PB&F process? How are they able to manage their data as a corporate asset rather than being overwhelmed by disconnected spreadsheets with poor data governance?

They have these common elements:

What can we learn from the 5% of transformation leaders who have completely transformed their PB&F process? How are they able to manage their data as a corporate asset rather than being overwhelmed by disconnected spreadsheets with poor data governance?

They have these common elements:

When you try to update your forecasts with actual results, the data from the GL doesn’t line up with the forecast assumptions. The forecasts are built with assumptions that aren’t captured in the GL. So the month end variance analysis doesn’t help you explain the change in your forecasts.

If you can’t explain the changes in your actuals, how can you update your forecasts? If your data systems don’t integrate, then every time you get actuals you have to redo your analysis. It takes too long, so you only do it once a quarter, or more likely when there is a dramatic change that forces it. By then it’s too late. You’ve missed the early signals that would have allowed you to react, and now you’re back in a crisis reacting.

When your data and systems aren’t integrated, you rely on the institutional memory of employees, who use their “past experience” as a guide as to what the issue is. But looking in the rear-view mirror for answers isn’t good enough anymore. And it makes you even more vulnerable when you lose those employees, because now your institutional knowledge just walked out the door.

The last year showed us how critical it is to be able to accurately predict cashflow needs AHEAD of time, to enable the right level of adjustments – whether it be cost cutting, bridge financing or finding alternate sources of revenue. If you’re just guessing or hoping that you will get through a crisis, the battle is already likely lost. You just don’t know it yet.

In reviewing forecasting challenges, we also need to focus on the month-end close process – the source of much of our data.

When you try to update your forecasts with actual results, the data from the GL doesn’t line up with the forecast assumptions. The forecasts are built with assumptions that aren’t captured in the GL. So the month end variance analysis doesn’t help you explain the change in your forecasts.

If you can’t explain the changes in your actuals, how can you update your forecasts? If your data systems don’t integrate, then every time you get actuals you have to redo your analysis. It takes too long, so you only do it once a quarter, or more likely when there is a dramatic change that forces it. By then it’s too late. You’ve missed the early signals that would have allowed you to react, and now you’re back in a crisis reacting.

When your data and systems aren’t integrated, you rely on the institutional memory of employees, who use their “past experience” as a guide as to what the issue is. But looking in the rear-view mirror for answers isn’t good enough anymore. And it makes you even more vulnerable when you lose those employees, because now your institutional knowledge just walked out the door.

The last year showed us how critical it is to be able to accurately predict cashflow needs AHEAD of time, to enable the right level of adjustments – whether it be cost cutting, bridge financing or finding alternate sources of revenue. If you’re just guessing or hoping that you will get through a crisis, the battle is already likely lost. You just don’t know it yet.

In reviewing forecasting challenges, we also need to focus on the month-end close process – the source of much of our data.

In my experience the Planning teams and Reporting teams tend to focus on different priorities and projects at any given time. The reporting team is usually rushed on month end or year end looking backwards, and the planning team is working with the business looking forwards.

But if you can take the time to agree on the key revenue and expense drivers for the business as a whole, and educate ALL the teams on the importance of capturing the critical KPI’s at every step, then you can hand off data from one team to the other much more seamlessly.

You don’t need sophisticated tools to do this part – it’s the discipline to take the time to design your process as an integrated whole, instead of individual cycles. And once you have that, you have the foundation you need to successfully implement the right planning tools.

In my experience the Planning teams and Reporting teams tend to focus on different priorities and projects at any given time. The reporting team is usually rushed on month end or year end looking backwards, and the planning team is working with the business looking forwards.

But if you can take the time to agree on the key revenue and expense drivers for the business as a whole, and educate ALL the teams on the importance of capturing the critical KPI’s at every step, then you can hand off data from one team to the other much more seamlessly.

You don’t need sophisticated tools to do this part – it’s the discipline to take the time to design your process as an integrated whole, instead of individual cycles. And once you have that, you have the foundation you need to successfully implement the right planning tools.

1 – Centralize your business model by integrating your processes and create one source of the truth. The hard work is in aligning your processes between functions to eliminate the inefficiency and rework that comes from each team designing for themselves. The payoff makes it worth it!

2 – It’s time to get rid of the spreadsheets. You’ll never get out of excel hell until you make it a priority.

3 – To break the spreadsheet habit, automate with the right tools.

It is so critical to invest in these tools before the next crisis hits us. There will never be a time when it’s easy, just a time when with determination, resources and making it a priority, you can get it done.

1 – Centralize your business model by integrating your processes and create one source of the truth. The hard work is in aligning your processes between functions to eliminate the inefficiency and rework that comes from each team designing for themselves. The payoff makes it worth it!

2 – It’s time to get rid of the spreadsheets. You’ll never get out of excel hell until you make it a priority.

3 – To break the spreadsheet habit, automate with the right tools.

It is so critical to invest in these tools before the next crisis hits us. There will never be a time when it’s easy, just a time when with determination, resources and making it a priority, you can get it done.