What if you could hire the perfect financial planning & analysis (FP&A) team? With rising concerns about recruitment in finance, many organizations are having trouble finding the right talent to support corporate performance.

In the United States, CFOs are offering as much as 54% more money to new hires in order to remain competitive in the job market.[1]

Your organization’s FP&A team is a crucial part of your corporate performance. FP&A teams are responsible for “budgeting, forecasting, and analysis that supports the major corporate decisions of the CFO, CEO, and the Board of Directors.[2]”

Few organizations are successful without the careful financial planning and cash flow management of their FP&A team. But how can you be sure you’ve hired the right people for the job?

In this article, we will cover 5 key traits to look for when hiring FP&A professionals.

Want to learn more about how to crush your FP&A? Download our report.

Build & Analyze Financial Models

Perhaps one of the most important skills for FP&A professionals is the ability to build and analyze financial models. This should be considered a core competency of anyone you hire, as it will be difficult for them to succeed in this role without strong analytical skills.

Candidates should also be able to demonstrate strong Excel skills or have prior experience with Performance Management tools as a way to measure corporate performance.

With recent technological advancements in finance software, FP&A team members have to be prepared to adapt and learn new solutions outside of Excel, including Enterprise Resource Planning or Corporate Performance Management software. Our recent blog speaks more in-depth on hiring technology as part of your FP&A team.

Want to improve corporate performance with FP&A? Our report has the details.

A Diverse Background & Ability to Influence

When hiring for your FP&A team, it can be advantageous to consider candidates who have worked in different departments or on cross-functional projects. Candidates who have job experience outside of finance are better at connecting what’s happening in the business with its financial implications, giving them a better understanding of corporate performance.

FP&A can positively impact your organization’s health – download our report.

A diverse background can also give candidates the sought-after people skills that are key to extracting financial information from other departments within your organization. Familiarity with department managers can make dealing with “internal customers” an easier process, especially if those managers are reluctant to speak to finance.

Motivation & Bold Thinking

Hiring candidates that are intrinsically motivated is a great way to ensure your FP&A team is made up of finance innovators and thought leaders. The best finance professionals are interested in growing their career and learning new skills in every position they take on. An interest in continued learning is a good sign that an employee is passionate about their role and invested in your company’s corporate performance.

A focus on innovation will also require that applicants are bold thinkers – identifying opportunities to automate, improve, and refine business processes. Bold thinking requires a focus on the future, a growth mindset, and an ability to manage uncertainty. If all these things are done well by your FP&A team, your company’s corporate performance will benefit.

Communication

Finance professionals need to be able to prepare, present and summarize key financial findings. Interested candidates should be able to tailor their communication-style to suit managers, coworkers, and clients and pivot their message to different channels, platforms, and styles.

FP&A professionals should be able to position themselves as storytellers who can accurately articulate financial results and advise business leaders of the next action they should take. As technology continues to advance, more importance will be placed on FP&A to foster relationships with management and business leaders, emphasizing the importance of communication.

Leverage the power of FP&A to improve corporate performance with our report.

Decision-Making & Project Management Skills

And lastly, finance professionals should possess strong decision-making and project management skills. Candidates should be able to work both independently and as part of a larger team.

All members of your FP&A team should be able to look at a data set and recommend a decision – the focus should be on what to do rather than on what the data says.

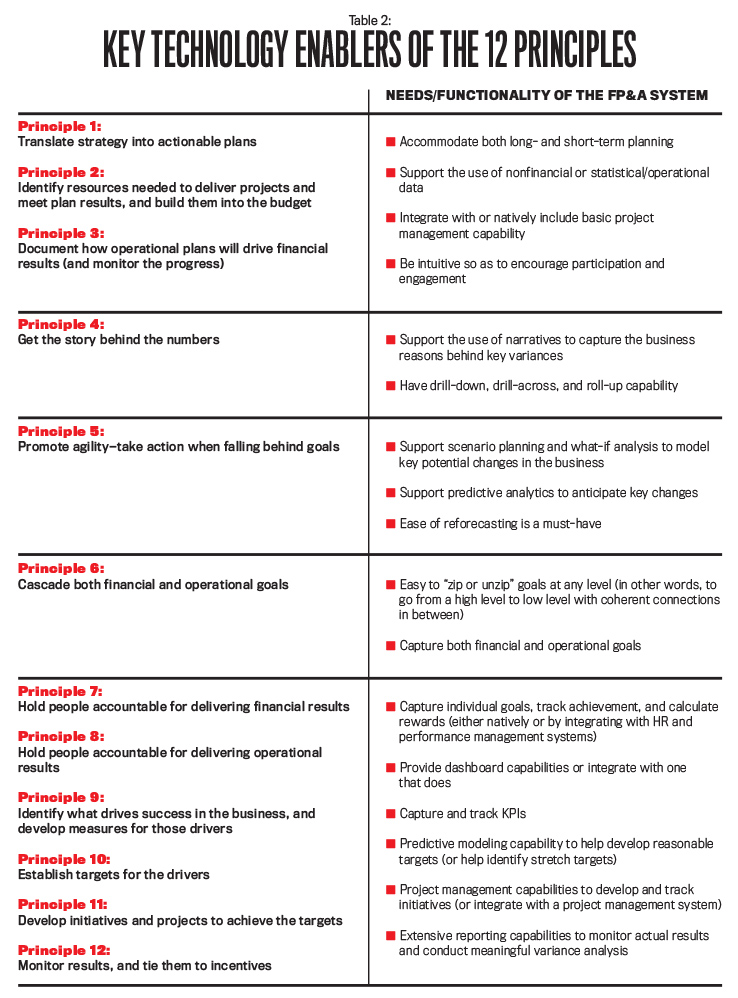

Part of the decision-making process is effective project management. In the results of IMA’s Global FP&A Survey, they outline the project management functionality that every FP&A team should possess. This includes the ability to “integrate with or natively include basic project management capability.”

Looking to improve your corporate performance with FP&A? Our report explains.

Conclusion

There is no need to be daunted by the prospect of hiring a talented and dedicated FP&A team. In this article, we outlined 5 key traits to look for in your next FP&A applicant:

- An ability to build & analyze financial models

- Diverse work experience with an ability to influence

- Intrinsic motivation and a penchant for bold thinking

- Strong communication skills

- An ability to manage projects and make strategic decisions

What skills do you look for when you hire FP&A professionals?

Ready to revolutionize FP&A? Download our report.

[1] http://www.cfo.com/hiring/2016/01/many-cfos-paying-premium-new-talent/

[2] https://corporatefinanceinstitute.com/resources/careers/jobs/financial-planning-and-analysis-fpa/