“Putting alloys on a banger.” “A Ferrari engine in a Lada.”

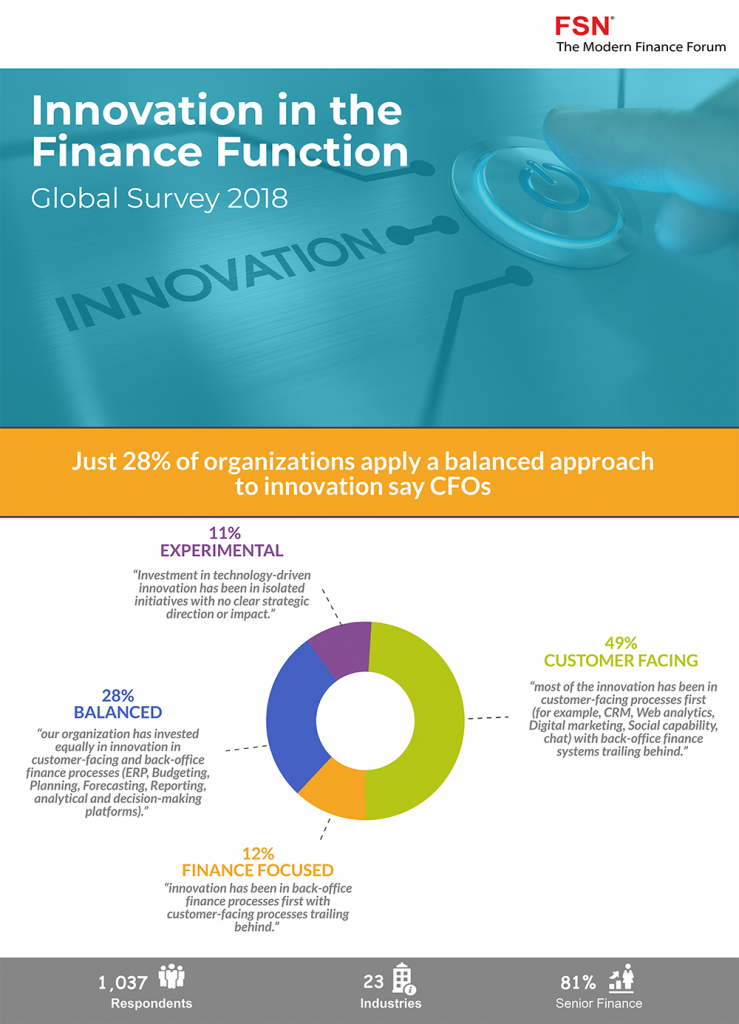

Even if you stick to car metaphors, we have lots of different ways to describe the mistake of an unbalanced investment. And yet, according to the latest FSN survey, investment in innovation remains deeply unbalanced across many businesses. Just 28% of over 1000 respondents reported that their organisation spent equally across back-office and customer-facing functions. 49% report a focus on customer-facing technologies, such as CRM, social media and web analytics, with the back office trailing behind.

It would be tempting to say this focus on the outward-facing aspects of the business is rather close to the “alloys on a banger” metaphor. But in the current climate, this targeting of investment is, at least, explicable. Expectations of service and performance are undoubtedly rising, driven by consumers’ daily experience of low-friction interactions with online retailers and social networks. Even in totally unrelated sectors, such as local government, these experiences have changed expectations. Experience instant service in one place and you come to expect it everywhere.

However, the arguments for investment in the front end alone fall down when you consider the underlying objective. Growing customer satisfaction has no meaning on its own, it is just one ingredient in a recipe for building sustainable success. Fail to invest in the back end, as well as the front, and you just move the bottlenecks and create new risks.

Just as customers are demanding accelerated performance from suppliers, the accelerated market demands faster strategic decisions from the whole organisation. These can only be supported by enhancing finance processes to provide the insight and support required to underpin these decisions. Technology can reduce friction in customer interactions but it can also reduce friction in finance processes, freeing staff to provide more strategic analysis and support, and diminishing the risk of performing under pressure.

Every investment in new technology must pass through the finance team. And yet, it seems finance continues to attract the lowest levels of investment in the business – at least in most cases. 12% of companies report that finance is leading investment in innovation in their organisation and threatening to pull away from the customer-facing functions.

This is no less damaging than the reverse. If you want to build sustainable success, what is needed is balanced investment across the organisation.