First the bad news. 2020 was a challenging year for colleges and universities. Enrollment for the fall 2020 term was down 3.3% from the prior year. The higher-priced international students enrollment was down 16%. It has been a struggle. Finance teams have had to step up further and be front-and-center to shepherd the schools through this challenging time.

There is a silver lining of course. The pandemic is accelerating digital transformation, and this will improve the quality of remote learning options. Utah State University and many of our other Higher Education customers are offering fully online degrees. Colleges and Universities are viewing online learning as mandatory and dedicated offerings rather than as complements to existing in-person programs. This has tricky pricing implications for many schools and it has implications for students who prefer in-person options, but it also greatly increases the pool of possible candidates for the institution. This trend is also great for people everywhere – Education is becoming more global and less limited by geography and financial means.

If you oversee the finance team at a University or College, you now have numerous short-term implications and challenges to navigate through.

What will be your true enrollment for the summer semester and for the 2021/2022 academic year?

While students typically enroll for a semester three months or more in advance, they can usually cancel and withdraw within a month of the first day of school. As question marks remain around vaccine efficacy and around community confidence, it has become much harder to forecast enrollment in a timely manner. Conversely, will enrollment be a lot higher as new students who held off for 2020/2021 decide it is now safe to attend school?

Will in-person enrollment return to pre-pandemic levels?

In-person enrollment effects multiple areas and a precipitous drop has a wide-ranging impact. For one thing, net income from dormitories often funds administrative departments and other functions of the school. In-person “activities” related to things like athletics have also resulted in a loss of funding. Lastly, universities and colleges are facing an overwhelming sentiment towards lower tuition fees for distance learning: a survey by the Charles Koch foundation found that 9/10 students think they should be paying less for distance learning.

How will changes in enrollment affect our staffing levels?

Many higher education institutions have had to furlough employees and reduce staffing because of revenue shortfalls and fewer in-person learning. Some of these staff (such as library, boarding, food & beverage, and athletics) are tied to in-person attendance and the volume of students on campus. Others, such as the number of teaching assistants or faculty might be tied to enrollment. Finance teams need to understand the relationships to different types of staff and the student mix for the upcoming semester.

What is our funding shortfall?

You can deal with funding shortfalls by cutting costs and you can deal with them by pursuing new sources of funding outside of tuition revenue. Can you work with Alumni relations to drive more from donors? Is a larger drawdown from the endowment fund appropriate? Are there additional federal or state funding options available?

The answers to these challenges are not obvious and require careful consideration. The office of finance is more important than ever to (1) understand the current financial picture and (2) partner closely with the office of the dean, admissions, alumni relations, student services, and other functions to navigate through this challenging time.

There are four focus areas for Finance teams to level-up and meet this challenge head-on:

- Adopt an active and continuous planning process

- Connect your staff plan

- Take enrollment and net tuition revenue planning to the next level

- Use different scenarios

Adopt an Active and Continuous Planning Process

The antidote to many of the challenges discussed earlier lies with active and continuous planning. The days of a once-annual, monolithic planning process need to go. In their place, a planning process that can occur at any time throughout the year, as often as needed. In times of great uncertainty, you plan more frequently.

You probably do not know how many international students will return for the fall 2021 semester at this point, it is impossible to predict with the same accuracy as years past. But as the year passes, this becomes clearer and clearer and your plan gets adjusted.

This is hard to do with a traditional Excel-only planning process. It is difficult getting e-mailing department owners and getting feedback on a timely basis. Prophix lets you set up a rolling planning process that can be turned on or off when needed with minimal effort, so that you focus on planning and not fighting with Excel.

Take Enrollment and Net Tuition Revenue Planning to the Next Level

Earlier in this post, we mentioned that total enrollment was down 16% for international students and 3.3% for all students. That is only half the story. If we isolate on just “new” enrollment for the 2020/2021 academic year, Freshmen enrollment was down 13% in total and a whopping 43% for freshmen international students.

So to put this another way, most of the drop for the 2020/2021 academic is from lower new admissions rather than students who chose not to continue into sophomore, junior, and senior years.

This drop in new enrollment does not end with the pandemic. The drop will ripple through the system for the next 4-6 years as this group of freshmen move through the system to graduation. The situation cries out for a more detailed approach to enrollment and net tuition planning.

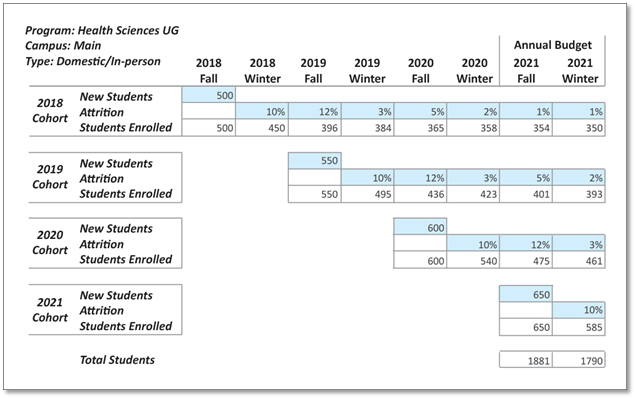

Planning by student cohort is one of the solutions to this challenge. Planning by student cohort allows you to set different tuition prices and attrition assumptions by semester. You can also plan by the type of admission type, such as international vs. domestic and in-person vs. distance education.

Here is a sample of how the enrollment budget might be created. The 2021 enrollment is result of the 4th year/seniors from 2018, the 3rd year/juniors from 2019, the 2nd year/sophomores from 2020 and the 1st year/freshmen from 2021.

If you have ever tried to model enrollment and tuition revenue by cohort, program, campus, or other factors using pure Excel, you have probably had a frustrating time. If you have, for instance, 3 campuses, 200 programs, 2 student types (in-person vs online), and 5 student cohorts (assuming all students wrap up within 5 years), then you would have had as many as 6000 unique “models” to painstakingly keep track of. It is not practical from a maintenance perspective and it is not what Excel is designed for.

Prophix helps you to centralize the planning logic so that you only create your planning model once. Your centralized model then easily propagates across all your programs and student cohorts, while you can load or input top-down assumptions and then tweak them for specific programs, all while being able to slice and dice the results for variance reporting afterwards.

“Connect” Your Budget

Since fluctuations in enrollment and tuition revenue is a given at this point, it is important to understand the relationships between changing revenue and the different expenses that a university or college incurs. There are many direct relationships-

- Certain types of student-facing administrative headcount are depending on the in-person education

- Teaching assistants and even tenured and untenured faculty are based on the total enrollment

- Facilities and janitorial services expenses go down with lower

- Software and IT costs may go up with higher ratios of distance education

Prophix lets you directly connect your enrollment plan with many of your expenses so that departments are not planned in “silos”. In other words, if you plan a drop in enrollment, corresponding expenses are also impacted at the same time rather than being disconnects from each other. Prophix lets you centralize these calculations so that the system keeps up with the ebbs and flows of a changing budget.

Prophix also lets you do a top-down vs. bottom-up staffing plan. The finance team may automatically conduct a top-down position-based plan using drivers and formulas while individual department owners may plan individual headcount. You would then compare the two plans and iterate until you have a workable plan.

Develop Various Scenarios

You cannot predict the future with certainty. Will students confidently return to in-person learning for September 2021? Will the prospective students who decided to skip the 2020/2021 year come back add to the existing 2021/2022 cohort? How effective will the vaccines be and will distance education be the norm for another year?

Creating multiple budget scenarios, some with the best case, some with the worst case, and likely scenarios in between, helps you to get a grasp on what is coming and helps you to plan for unknowns that will be revealed in the coming months.

The traditional challenge with creating multiple scenarios is the time-consuming and manual nature to creating meaningful budget iterations. With Prophix, this job becomes much easier. You can make broad sweeping changes to enrollment and pricing assumptions and having those changes propagate through your planning model down to the lowest level. You can easily create different staffing plans and attach them to different financial scenarios. You can make broad changes to expenses budgets or you can empower your end-users to keep their own budget iterations.

The key to navigating this difficult time, and to take advantage of times of opportunity, is to be adaptable and dynamic with your planning processes. Prophix helps you to modernize all the tedious and impractical components of a detailed financial plan and lets you focus on analysis and being a strategic business partner to your university or college.