The financial consolidation and close process can often be a frustrating experience due to its repetitive nature, time commitments, and its fair share of manual workarounds. Regardless of these pain points, it must be done.

The month-end close process is needed to produce accurate and timely financial statements because important decisions need to be made using this data. And, who can afford any compromises to their data when “it is the most important currency used in commerce today.” It also needs to be timely. Taking cash on-hand as an example, finance and accounting teams need to reconcile their month-end cash balances immediately to raise any discrepancies with their banks, since they only have a limited number of days to file a claim. To make matters more complicated, data keeps growing exponentially, especially as your business scales, thereby increasing complexity and hampering productivity. Don’t you wish there were a better way?

A New Way to Consolidate

If you can relate to any of the points mentioned above, then now might be the time to reflect on and change your outdated financial consolidation and close tactics. A modern mechanism is needed that weaves people, data, and processes together across your organization.

Including the right people will empower them to be more responsive and effective in managing the process. It’s a best practice to map your cycles, document your procedures, and put in place good internal controls that can drive accountability, workflows, and lead to actionable results. Data and processes can be harnessed with unifying technologies like Prophix’s Corporate Performance Management (CPM) software, which can integrate with disparate business systems and charts of accounts. CPM solutions are highly configurable and can automate financial reporting, consolidations, and planning. For the close process, CPM software can not only automate currency conversions and eliminations, but it can also accelerate consolidations with robust journal entry and audit capabilities, giving you clear insight into your business performance.

By automating manual processes, finance teams can dedicate more time to analyzing data instead of gathering it. If you have multiple entities with different systems, then bringing this data together is often a manual process. Even once you have gathered all your data, it needs to be integrous, cleaned, updated, and wrapped in accounting rules. You need a solution that connects and unifies your data into one window so that if something does not line up, you can rectify it immediately.

For example, using functionality that lets you drill across into transactional-level data tables. In this regard, CPM software offers a holistic solution that lets you focus on value-added activities, such as making strategic recommendations and generating insights. Other benefits that CPM can provide with regard to consolidation and close are time savings, greater accuracy, confidence, and reduced financial risk. This is achieved through simplified account reconciliations, automated processes, consolidation entries, ad hoc analytics, and easy-to-use data management and mapping capabilities.

Anomaly Detection, Powered by Artificial Intelligence & Machine Learning

In an earlier blog entitled, Speeding up Consolidations and Close with CPM, we discussed using Corporate Performance Management (CPM) as a solution to speed up the close process and teased the concept of leveraging Artificial Intelligence (AI) to help.

Now it’s time to elaborate. Cloud computing and AI lets businesses analyze data much faster and more accurately than any human could, allowing you to close your books in record time. Many CPM vendors are now exploring natural language processing (NLP) to level up their offerings. From Prophix’s perspective, our Virtual Financial Analyst lets you do routine work simply by asking your voice-enabled communications assistant. You can also get detailed narratives behind your data points and key metrics to uncover meaningful insights and trends. Combine this with Anomaly Detection, that not only speeds up your close process, but also reduces financial risk, and you have a winning close combo.

If you are unfamiliar with Anomaly Detection, let me explain. Prophix’s Anomaly Detection uses Machine Learning (ML) to analyze financial transactions and highlight actionable insights. It is capable of processing massive amounts of data to unearth irregularities. This means that when you’re closing your books, you can rely on ML to process 100% of your transactions for full coverage.

It would be impractical or nearly impossible for someone on the finance team to sift through all this data to find risky transactions. The advantages here are a reduction in errors, reduced losses, and lower overall costs. The point is no matter how efficient your FP&A teams are, if reconciliations are being performed manually using rules-based methodologies, then you will always be at a competitive disadvantage relative to your competition that automates their close using AI.

Anomaly Detection is different because it uses a combination of rules-based testing, statistical modeling, and Machine Learning to identify risk within your data. The algorithms use 28 control points based on industry knowledge to categorize transactions by risk level. The high-risk items, such as outliers, would normally be picked up using rules-based processes, but it’s the medium-risk transactions that can often slip through the cracks. Anomaly Detection focuses on these so that you are expediting the resolution more than focusing on the investigation.

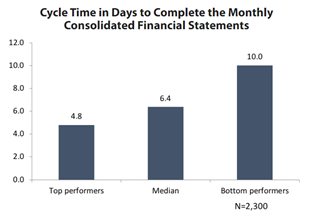

A 2018 survey conducted by CFO.com noted that the median close time from a sample size of 2,300 organizations was 6.4 days. That’s about a week-and-a-half in calendar days to close the books and annualizing this leads to 18 weeks a year. Four-and-a-half months is just way too much time to be spending closing your books every year. And guess what the biggest contributing factor to shaving this time was? “Good quality data”.

Source: https://www.cfo.com/financial-reporting-2/2018/03/metric-month-cycle-time-monthly-close/

The truth is every organization is unique and CPM solutions are no different. Just like the close process, there is no one-size-fits-all approach. When looking for a streamlined financial consolidation and close solution, we urge you to view your problems from a holistic lens. A lens that covers all facades of the Office of Finance, and not just consolidations and close, because a review of the overall function will yield the best return on investment for your organization.

While AI in the FP&A world is still in its infancy stage, be sure to research forward-thinking CPM vendors who are dedicated to harnessing the power of cloud computing and Machine Learning to provide you with long-term value.

Are you ready to take the leap and revamp your financial close process? And just as I wrapped up my blog, I ask you with all of the additional time savings, imagine what else could your team focus on or maybe you’d simply be happy to reduce the long days, late nights and get your weekends back?